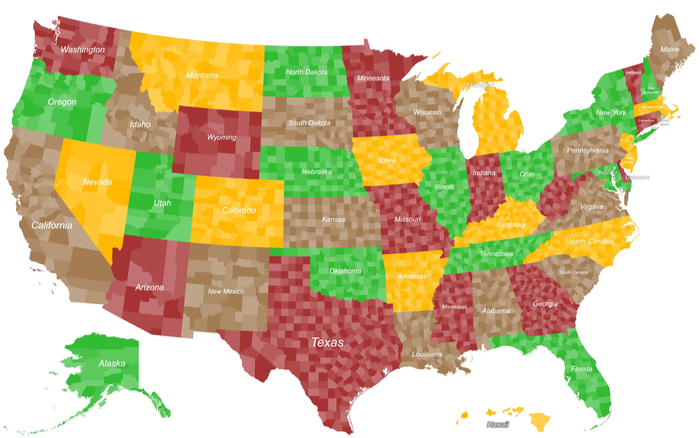

Cities, municipalities and counties rely on property taxes to fund their budgets to provide services like police and fire departments, public school systems and road maintenance crews. Regardless of what locality you call home, fairness, equal treatment and uniformity are likely the central themes of your local property tax system.

That’s not to say that property taxes are levied equally or uniformly in every jurisdiction in the United States. In fact, the contrary is true.

Most government jurisdictions below the state level in the United States levy a tax on interests in real property. Certain features of these local property tax systems are near universal:

Assessment ratios and tax rates vary from jurisdiction to jurisdiction and may vary within a jurisdiction for different property types. Tax rates on a particular piece of property may vary depending on who owns it, how it is being used and when it was last sold.

Because the property tax system is so complicated, taxpayers naturally try and figure out ways to make it work in their favor. For example, growing a small amount of produce on an otherwise industrial plot of land may qualify the site as agricultural land and reduce its taxable value.

The history of the United States can be viewed as a struggle between two contradictory inclinations:

This dichotomy has been reflected in our property tax system since the beginning.

During the Revolutionary War, the colonial government was forced to increase tax rates several times over to fund their war against the British. Public outcry was widespread. Interestingly, the complaints had less to do with the high levels of taxes and more to do with the fact that the tax burden was not being equally distributed among all citizens.

Because taxes were being assessed at an equal rate per acre but not taking into account the value of the land, poor farmers that owned many acres were paying more than rich urban dwellers who owned less land. Following the war, there was a renewed push to expand the notion of equality under the law to include how property taxes were levied. That meant a more fragmented property tax system.

As the frontier was settled, property taxes provided local governments with a reliable way to collect taxes in areas where there were few businesses and little commerce. As a result, property taxes became a principal source of revenue for local governments, and this remains true to this day.

About System 2 Thinking

System 2 Thinking is trusted by real estate service providers, tech startups and Fortune 1000 companies to consistently deliver transformational outcomes in competitive environments.

We drive innovation and fuel business acceleration with compliance consulting, licensing, innovation strategies, technology rollouts and process optimization.

Visit our homepage to learn more.